Overall, if a property's expenses are rising faster than its rent, the OER will continue to rise, making the project increasingly unprofitable. That, in turn, can be used to determine an action plan to cut costs (i.e. In addition to comparing different properties, a year-by-year OER comparison can also be used on the same property to determine if expenses are rising too rapidly in a particular area (i.e. For example, if an investor wants to purchase a industrial property with a 55% OER, and most similar industrial properties in the area have a 40% OER, the investor could probably conclude that the property is not being managed effectively. In commercial real estate, operating expense ratios are most commonly used to compare similar properties to determine if a property is being effectively managed. How Commercial Real Estate Developers and Investors Use Operating Expense Ratios However, loan payments and capital expenditures ( CapEx) designed to make a property more valuable or to replace a major system, are not.

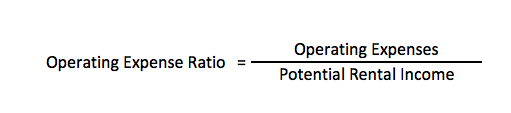

In general, expenses such as utilities, waste removal, repairs and maintenance ( R&M), management fees, insurance, and property taxes are included in OER. Then, they can add in any other estimated sources of income, and subtract the expected rate of vacancy to determine a realistic operating expense ratio. If a property has not yet been built, investors and developers can substitute gross operating income for gross potential rent (GPR). Operating Expenses/Gross Operating Income = Operating Expense Ratioįor example, a building with operating expenses of $40,000 a year that brings in $100,000 of gross income would have a 40% OER.

To determine a property's operating expense ratio, use the formula below:

What is an Operating Expense Ratio in Commercial Real Estate?Īn operating expense ratio, or OER (sometimes simply known as an expense ratio) is a metric comparing a property's operating expenses to the amount of income it generates.

0 kommentar(er)

0 kommentar(er)